Autumn Statement – Response From An Ex HMRC R&D Tax Inspector

Autumn Statement: Changes to the R&D Tax Credit Scheme and what you need to know

The Chancellor of the Exchequer, Jeremy Hunt, has made significant changes to the UK’s R&D Tax Schemes that will impact every company across the country.

Unfortunately, there have been scrupulous claimants and providers bringing unwelcome attention to the R&D Scheme for the wrong reasons. Predominately those without Ex-HMRC led compliance teams comprised of less experienced or diligent advisors and accountants. We have been campaigning for tighter policing of the scheme, but regrettably, in this instance, the chancellor took somewhat of an aim at the SME scheme itself.

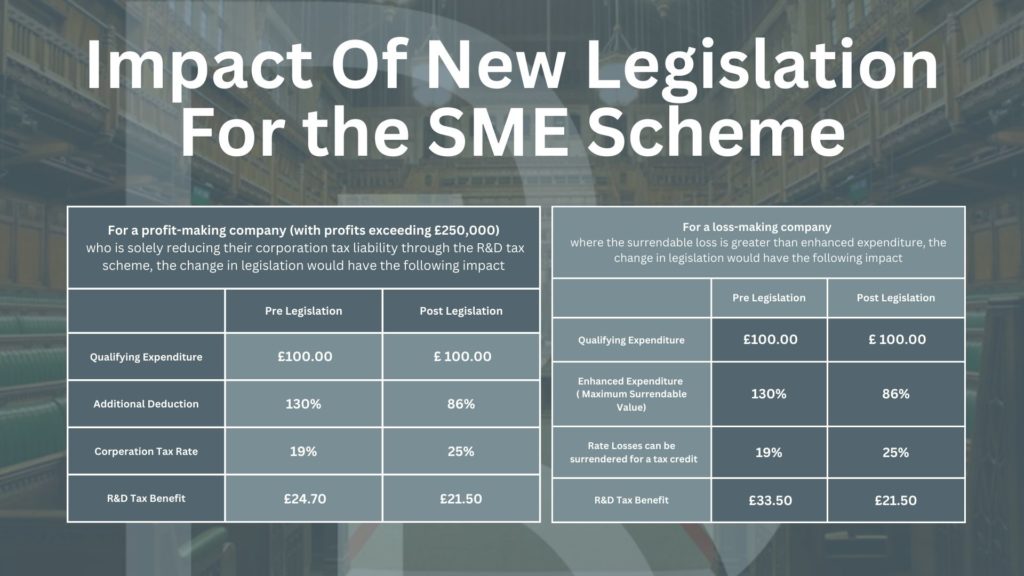

The generosity of the SME Scheme has been cut. Whereas the maximum benefit previously reimbursed up to 33.35% of qualifying expenditure (QE), the scheme will now drastically cut this total to a maximum of 21.5%.

In contrast the Research & Development Expenditure Credit (RDEC) is made more generous, increasing the level from 13% to 20% of QE.

Citing the risk of fraud in smaller claims, the Autumn Statement said: “As part of the ongoing review of R&D tax reliefs, the government is reforming the reliefs to ensure taxpayers’ money is spent as effectively as possible.

It continued: “By contrast, the separate R&D expenditure credit is better value but has a rate that is less internationally competitive. The government is therefore rebalancing the rates of the reliefs.”

The scheme has come under heavy scrutiny in recent months with newspaper reports citing several bogus claims and providers talking about the scheme as “free money”. Prompting a response by the exchequer on how the scheme is used and accessed. We welcome the increased scrutiny, to be frank. But regret that those who act with malpractice have tarnished and in this instance negatively financially impacted the 10,000s of legitimate claimants.

The scheme, however, is pushing forward. New costs are soon to be included such as data and cloud expenditure and these changes will be legislated for in Spring Finance Bill 2023.

What the tax calculation says:

Reforms to Research and Development (R&D) tax reliefs – For expenditure taking place from the 1st of April 2023. The Research and Development Expenditure Credit (RDEC) rate will increase from 13% to 20%, the small and medium-sized enterprises (SME) additional deduction will decrease from 130% to 86%, and the SME credit rate will decrease from 14.5% to 10%.

Please note that the below profitable examples are based on Year Ends commencing after April 2023, and are using the new higher rate of Corporation Tax (25%). Your company’s exact Corporation Tax rate will depend on how profitable the business is, as per Small Profits Rates and Marginal Reliefs.

What Next?

Be assured that Bonham & Brook is well prepared to help your company in the transition and is proud to continue to harness a market-leading compliance department. We welcome any questions you may have about how this change will impact your business. Please reach out to us if you would like to know how you may be affected.