Stamp Duty Land Tax: Unlock Property Savings

Stamp Duty Land Tax (SDLT) is a form of tax that needs to be paid to HM Revenue & Customs when purchasing a property or land in England and Northern Ireland. The specific amount of SDLT payable, or whether it needs to be paid at all, is determined by both the purchase price of the property or land and the buyer’s individual circumstances.

Key Historical Changes to Stamp Duty Land Tax (SDLT)

- SDLT replaced stamp duty on land in the UK on 1 December 2003.

- The Finance Act 2012 introduced a 15% rate for high-value residential properties.

- The Finance Act 2013 introduced changes to sub-sales and assignment of contracts.

- The SDLT Act 2015 replaced the “slab” rates system with a “slice” rates system for residential property.

- The Finance Act 2015 replaced SDLT in Scotland and introduced LBTT.

- The Finance Act 2016 replaced the slab system with a slice system for non-residential and mixed-use property.

- The Finance Act 2018 introduced a permanent relief for qualifying first-time buyers.

- From 1 April 2018, SDLT in Wales was replaced by LTT.

- The Finance Act 2019 reduced the timeframe for delivering SDLT returns and payments.

- From 1 April 2021, a 2% SDLT surcharge applies to residential property purchases by non-UK residents in England and Northern Ireland.

Overview of Property Taxes When Purchasing a Property

- You must pay Stamp Duty Land Tax (‘SDLT’) if you buy a property or land over a certain price in England and Northern Ireland. It is a tax not a relief.

- In Scotland you must pay Land and Buildings Transaction Tax (‘LBTT’) if you buy property or land over a certain price in Scotland.

- Similarly in Wales you must pay Land Transaction Tax (‘LTT’).

- You pay tax when you:

- Buy a freehold property.

- Buy a leasehold property.

- Buy a property through a shared ownership scheme.

- Are transferred land or property in exchange for payment, for example you take on a mortgage or buy a share in a house.

Determining the Value for Stamp Duty Land Tax (SDLT)

The total value you SDLT on is usually the price you pay for property or land. The consideration is defined as money or money’s worth.

Sometimes it might include another type of payment like:

- Release from a debt

- Transfer of a debt including value of any outstanding mortgage

Thresholds for Stamp Duty Land Tax (SDLT)

- £250,000 for residential properties

- £425,000 for first-time buyers buying a residential property worth £625,000 or less (This will revert to £300,000 in 2025)

- £150,000 for non-residential land and properties

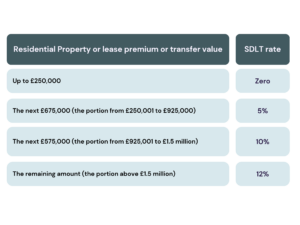

SDLT Rates for Residential Property or Lease Premium/Transfer Value

Surcharge and Exemptions for Additional Properties in SDLT – Schedule 4ZA

A 3% surcharge will apply on top of the rates stated above if the purchase of your new residential dwelling means you will own more than one.

However, if you are replacing your current main residence that has been sold then the extra 3% surcharge will not apply.

If you cannot sell your property in time but you do manage to sell it within 3 years you can apply for a refund from HMRC for the additional amount of tax

Higher Rate for Corporate Bodies in SDLT

SDLT is charged at 15% on residential properties costing more than £500,000 bought by corporate bodies or non-natural persons:

- Companies

- Partnerships where one partner is a company

- Collective investment schemes

The 15% does not apply if property is bought by a company acting as a trustee of a settlement.

There is relief available as long as one of the conditions in the legislation can be satisfied.

SDLT Rates for Non-UK Residents

An additional 2% surcharge will apply on purchases of Residential property by non-UK residents. The surcharge also applies to certain UK resident companies that are controlled by non-UK residents. The additional 2% doesn’t apply to mixed use or non-residential properties.

Determining the Amount of SDLT to Pay

This depends on the following:

- Whether the purchaser is an individual or a company

- Whether the land or property will be used a residential property or as a non-residential or mixed-use property

- Whether you are eligible for relief or an exemption

SDLT Reliefs and Exemptions

The Legislation allows for a number of reliefs and exemptions which could reduce the amount of tax paid by the purchaser.

-

Relief for First time buyers

- Multiple Dwellings relief

- Group relief

- Acquisition relief

- Chain Break relief

- Probate relief

- Acquisition by a house-building company from individual acquiring new dwelling

- Acquisition by property trader from individual acquiring new dwelling

- Higher-Value Residential transactions

- Partnership to Limited Company

- Mixed Use – Acquisition of residential and non-residential property

-

Derelict/Uninhabitable property

Get Started Today!