Engineering

In the engineering industry, the average R&D claim is £129,000 per year!

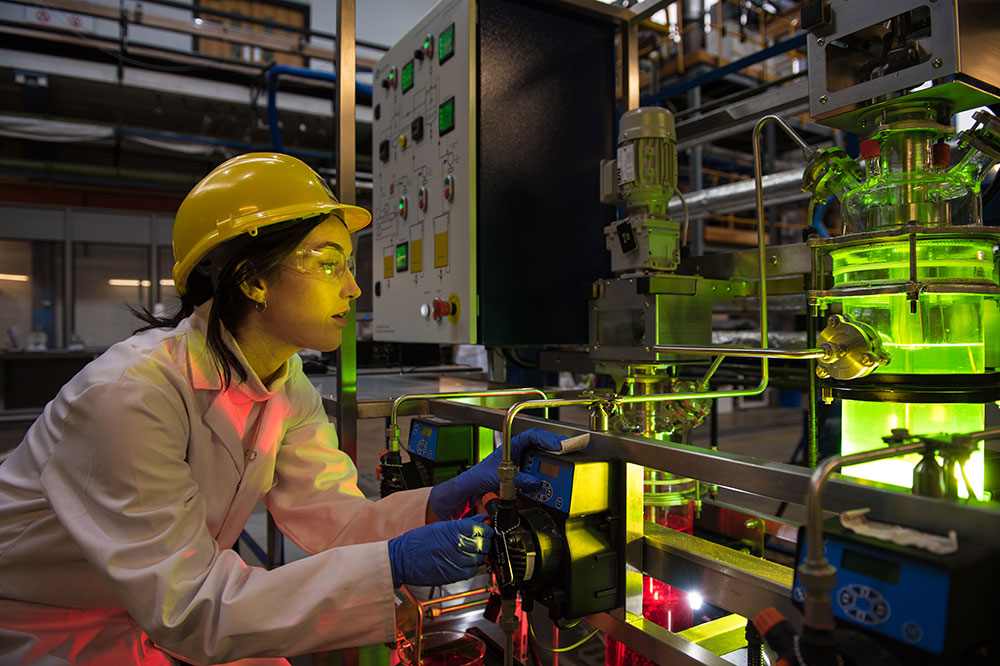

Engineering is all about solving technical problems and developing new and improved ways to apply technology, which results in constant demand for research and development.

While engineers may see themselves as problem solvers rather than innovators, it is precisely this type of daring mindset that the R&D tax credit scheme was designed to foster.

If you designed, invented, or improved a product/device/process within the last three years, you may be eligible for a significant annual pay out under the government’s R&D tax credit scheme. Unearth your full claiming potential with our expertly led team of ex-HMRC investigators, chartered accountants, tax law experts, and sector specialists.

Why Us?

- £50m Secured for 500+ businesses.

- 97% Client retention rate

- 500+ Businesses Supported

What counts as R&D for tax relief purposes?

We suggest evaluating your project against the following three criteria to determine if it meets the requirements for R&D classification in the eyes of HMRC:

- Is there technological uncertainty? If you took a competent professional in your field and gave them the documentation for your project, would the answer to your problem be readily deducible? If not, then you likely attempted to overcome some sort of scientific or technological uncertainty for your project to qualify.

- Have you achieved an advancement? The goal of any R&D project should be to take any given technology beyond what’s available in the public domain. So, if you’re doing something that’s never been done before to your knowledge, something that’s been done by other companies before in a way that was their own IP, or advancing an existing technology/approach beyond what it was natively capable of, then you could have done exactly that.

- Does it demand competent professionals? A professional in the relevant field shouldn’t be able to solve uncertainties with ease. A competent professional is one who is anticipated to be familiar with the pertinent scientific and technological principles involved, aware of the current level of knowledge, and has acquired experience and is acknowledged as having a successful track record.

Qualifying activities for Engineering R&D tax credits

The main goals of R&D are to resolve technical challenges, alleviate uncertainties, and develop advancements.

R&D can be seen in a variety of ways within engineering, but it is most frequently seen in the following:

- Use of new materials or a new combination of materials

- Appreciable improvement to an existing product or process

- Streamlining a process through automation

- Implemented in a unique or challenging environment.

- New or improved design of machinery, component, or electronic products

- Going through multiple technical iterations before going into production

- Innovative product development using computer-aided design tools.

- Developing unique computer numerical control programs

- Designing innovative manufacturing equipment

- Designing innovative programmable logic controllers

- Digitising manual machining processes

- Developing specialised tools to meet high-specification product designs.

- Integrating new technologies with legacy back-end systems

- Industries that have made successful engineering R&D tax credit claims.

if you think the work your company is doing may qualify, we would be happy to set up a free assessment call to help you better understand the possibilities and benefits of filing an R&D tax credit claim.

The following Engineering sectors qualify for R&D:

Aerospace engineering

Architectural engineering

Automotive engineering

Biochemical engineering

Infrastructure engineering

Chemical engineering

Civil engineering

Electrical engineering

Transport engineering

Petrochemical engineering

Plant engineering

Power engineering

Process engineering

Railway engineering

Software engineering

Structural engineering

Surveying engineering

Systems engineering

Telecoms and network engineering

Green engineering

Geotechnical engineering

Hydrology engineering

Manufacturing Engineering

Marine technology engineering

Motorsport engineering

Engineering relating to materials.

Mechanical engineering

Military engineering

Eligible R&D Expenditures for a engineering organisation Expenditures that can be accounted for in your R&D claim include:

- Payroll/staffing expenses for construction engineers, architects, designers, and project managers (gross wages, employers’ NI, and company pension contributions)

- Subcontracted R&D for the creation of novel construction equipment prototypes and cutting-edge construction software and applications, as well as external consultants for innovative ideas in construction techniques and materials.

- Consumable materials used in research, such as materials used in prototype creation or testing.

- Software and software licenses used in R&D, such as building simulation software and CAD programs.

- Compensation paid to contractors or workers for participating in performance studies or trials.

- Contributions to independent research institutions, such as universities and engineering departments, for joint research projects.

- Cloud computing and data storage costs incurred in R&D, starting from April 2023.

Our R&D Tax Credit Process

Our expert team of sector specialists, construction professionals, accountants, and former HMRC tax inspectors are uniquely equipped to uncover R&D expenditure in construction projects that other advisers may miss.

Our process has been tailored for the construction industry, designed to uncover eligible projects and compliantly maximise your claim.

EXPLORE: Schedule a free appointment below to determine your eligibility and your company’s total R&D tax position.

CREATE: We’ll create a claim that minimises your exposure to HMRC enquiries, speeds up the process, and undergoes rigorous compliance checks by our in-house team.

OPTIMISE: We’ll help you find additional sources of R&D funding and offer planning assistance for your R&D strategy, considering potential incentives and grants.

REWARD: We’ll help you safely receive the maximum tax credit available, supporting your future growth.#

What next?

If you believe your claim has not been fully optimised and you may be entitled to more compensation, or if you want to begin your first claim, seek professional advice from Bonham & Brook on how to proceed below.

Contact Us

Book A Meeting

Contact Us

Please get in touch and a member of our team will get back to you immediately.