Intro to R&D Tax

Welcome to R&D Tax Credits : Innovation’s Robin Hood

What is the Scheme?

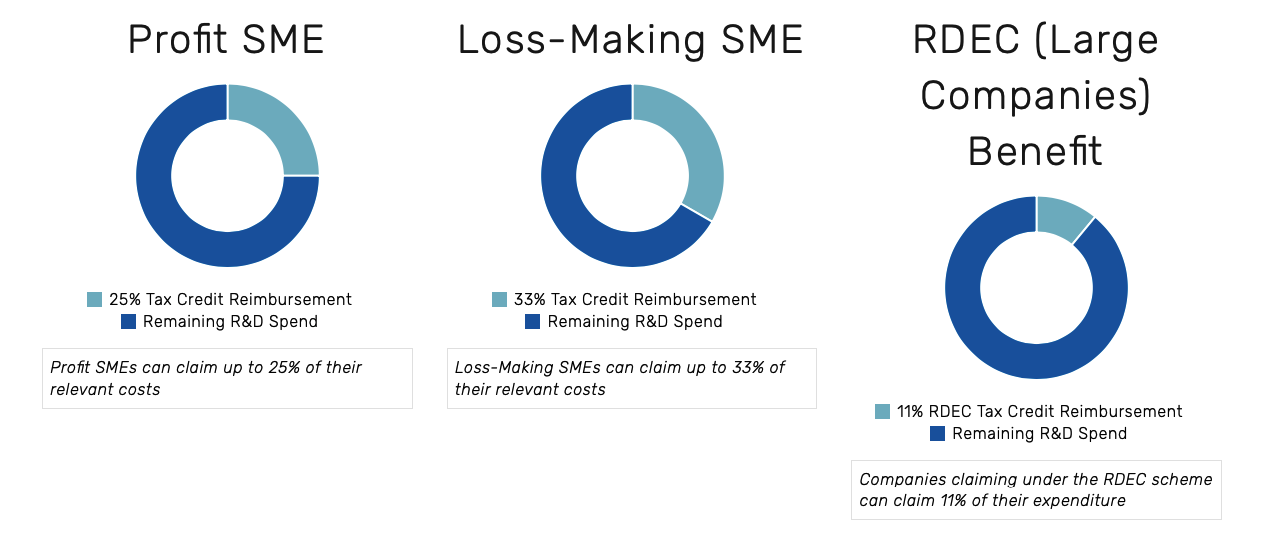

Essentially the scheme allows you to claim back 25%-33% of your relevant costs for an SME, or 11% of your costs if the company falls under the large company scheme.

OK – Why Is The Government Trying to Make Me Pay Less Tax?

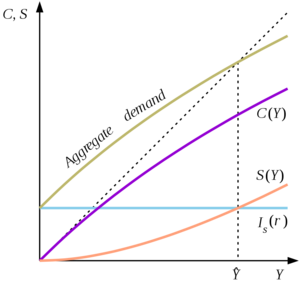

Keynesian Economics

The idea behind R&D Tax Credits is simple. More money in R&D stimulates more activity in the wider economy which in turn makes the economy more healthy overall

Keeping UK Businesses ahead of market trends is vital to its continued success as a major economy. Given our relatively diminutive population size relative to emerging economies – embracing technologies and innovation will be vital to maintaining our place as an economic world leader.

20 Years ago Britain followed suit behind other G8 Countries, such as France, in embracing R&D Tax Credits as a way to stimulate the most important aspects of the economy to ensure future prosperity.

What Qualifies as R&D Activity?

To qualify as R&D your business must be carrying out activities which satisfy these 3 key areas

- It must be expanding the state of knowledge in the industry

- It must entail the party carrying out the R&D to be carrying a burden of financial risk

- It must have employed a systematic approach.

For a broad idea of what qualifies in your sector please see the software, science or engineering pages .

What kind of costs can be included in a claim?

Great – I have those! How do I make a claim?

Regardless of how you go about preparing your claim, everyone submits it the same way. The claim end result of the financial calculations are added to a specific section of your company tax returns. Please note that just because you’ve already filed doesn’t mean its too late, we can amend previously filed tax returns 2 years retrospectively.

This amendment is the final figure that will be deducted from your tax liabilities, so it’s important. But be mindful that without substantiation you could be building castles on top of sand. In order to secure your benefit and ensure the HMRC doesn’t come knocking with awkward questions looking to take your benefit back – you would want to submit a technical narrative to the HMRC to explain why the work you carried out constitutes R&D.

This is where we help can help

What’s Involved in Making a Claim?

It’s fairly simple really,

We have a free consultancy with you where we discuss projects and ball park cost figures to give you an estimate of your benefit and our proposed fee.

- you give us your financials to do a bit of due diligence and a bit of extra homework on top.

- We have a technical interview with a technical lead from your company (a senior developer for example) and a technical consultant from our matched to your niche

- We begin a cost collection process and then begin compiling the narrative that will legitimise the claim

- Once the narrative has been reviewed and approved by both parties, it is reconciled with the financial case compiled by SME and submitted to the HMRC

- For SMEs, you’ll receive your benefit within 4-8 weeks.

What are the risks?

The risks of getting a claim wrong initially entails arousing the HMRC’s suspicion to the extent they launch an “enquiry” into the company’s R&D work and related expenditure. This can entail , in extreme cases, a line by line breakdown of the advancements carried out and an uncomfortable accountability of the day to day of the staff involved in the claim. In cases where the company isn’t able to provide a robust defence the company can then have their benefit refused. In cases where the benefit has been received already, it can be clawed back. Where the HMRC can argue that the company was claiming negligently or making purposeful misrepresentations, the company can be fined. This is why it’s advised to make a claim with professionals who can ensure that the company will only receive windfalls from the scheme rather than headaches and financial hardships! With SME Gov Capital Limited we have a 100% success rate in our claims, with the very few enquiries we have received (at a rate far below the national average) being successfully defended with no involvement of our clients.

What have you got to lose?

Well, that’s a very good question. With a professional adviser, nothing, and you have a lot to potentially gain. You’ve done the hard work already, now all that’s left to do is to claim what’s already rightfully yours. If this sounds promising then please get in touch on the contact form button below. We will be happy to provide a complimentary consultation so that you can give us a quick debrief on your business, and we can give you a ballpark figure as to your likely benefit and guidance on how to acquire it.